President Biden has brought relief to millions of Americans with his announcement of a $9 billion student debt cancellation. This significant decision on Student Debt Cancellation comes as repayments are about to resume after a three-year break. So, what implications does this have for students, graduates, and the future of higher education in the U.S.? Let’s explore.

The Backdrop

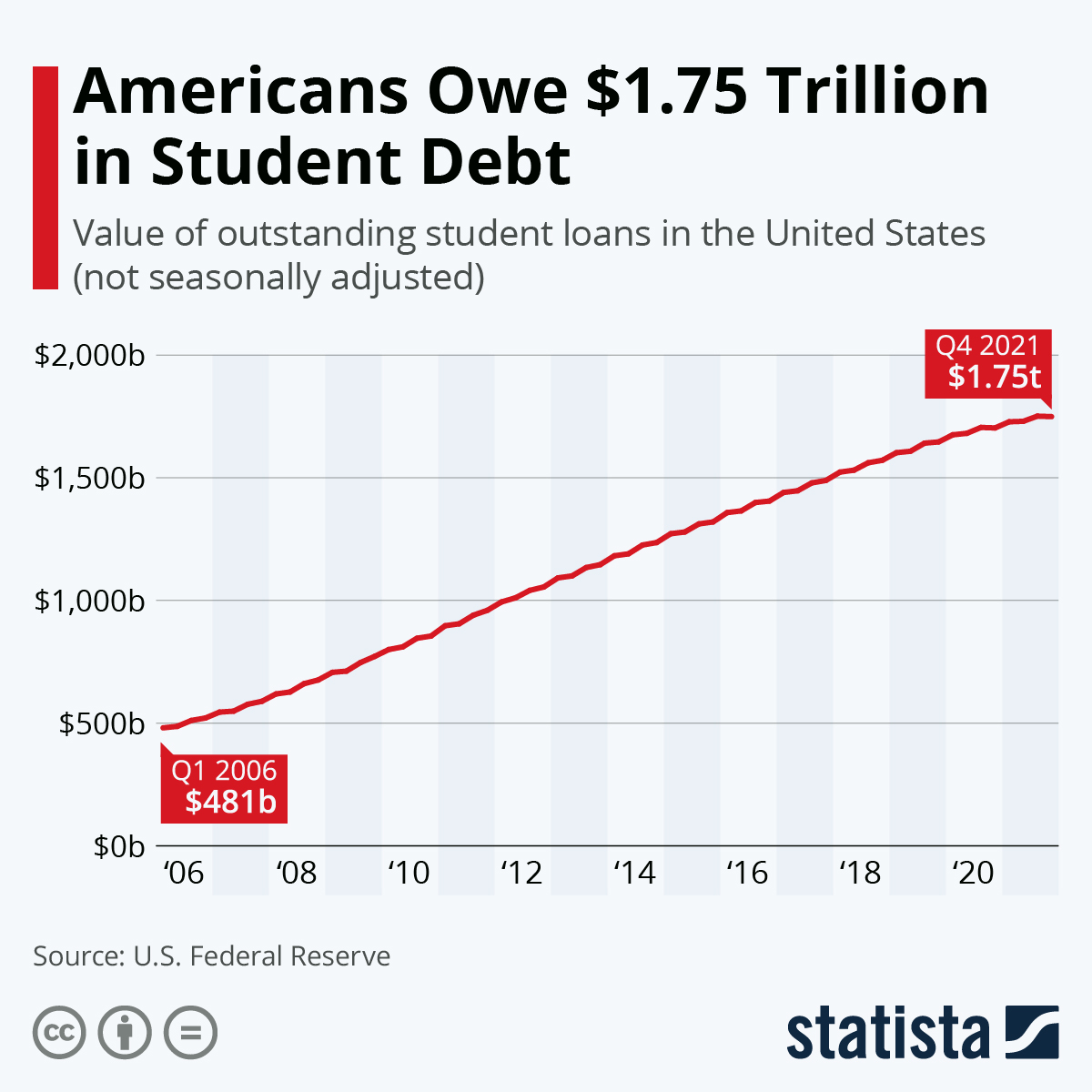

Many Americans feel the weight of student loans. The average student loan debt stands around $30,000, with the total U.S. student loan debt exceeding $1.5 trillion. The three-year repayment break, a response to the pandemic’s economic challenges, gave temporary relief but also heightened anxiety about the upcoming resumption of payments. Learn more about the U.S. student loan debt situation here.

The Impact of the Student Debt Cancellation

- Immediate Financial Relief: Those benefiting from the debt cancellation will experience an immediate financial relief. They can now redirect monthly payments, which many found challenging, to other essential expenses or savings.

- Boost to the Economy: Reduced debt concerns might lead to increased consumer spending. Graduates may now think about making larger purchases, such as homes or cars, which they might have previously delayed due to debt worries.

- Mental and Emotional Well-being: Reducing the psychological impact of debt can lead to a healthier, happier population.

The Larger Picture

While we should commend the $9 billion cancellation, it represents only a fraction of the total student debt. A long road lies ahead. However, this step sets a precedent and indicates a potential shift in the government’s approach to higher education financing.

What’s Next for Students and Graduates?

If you benefit from the debt cancellation:

- Stay Informed: Make sure you receive and understand official communication about the cancellation.

- Financial Planning: Think about consulting a financial advisor to plan investments, savings, or other financial goals.

For those still grappling with student loans:

- Stay Hopeful: This cancellation might hint at more significant changes on the horizon. Keep an eye on policies and potential relief measures.

- Continue Payments: Until further announcements, ensure you keep up with your loan repayments to avoid penalties.

For more insights on higher education and financial planning, stay tuned to Elite Collegiate Planning. If you want to understand more about financial planning for college, check out our comprehensive guide here.